We offer a variety of home loans. Use our Secure Loan Application and optional Secure Document Upload Portal to apply for a loan. Click here to get started!

Our experienced professionals offer superior quality support throughout the entire experience. Contact us today and let us go to work for you!

Here at MDI Mortgage, we have the right loan program for you. Whether you are looking for Purchase, Refinance, or Specialized Loans, we can do it!

When it's time to purchase or refinance, MDI Mortgage takes a consultative approach and aims to offer you an extensive array of mortgage loan programs to provide you with your best, personalized home financing solution.

Our reputation and commitment to total customer satisfaction is our most important asset. Our mission is to guide you through the entire home loan process so that you can feel confident as you make choices about options available for your financing strategy. With a tenured background in the mortgage services industry and local market expertise, we stand ready to assist along each step of the way.

MDI Mortgage provides pre-qualifications at no cost, fast approvals, and low rates designed to save you thousands of dollars over the life of your loan.

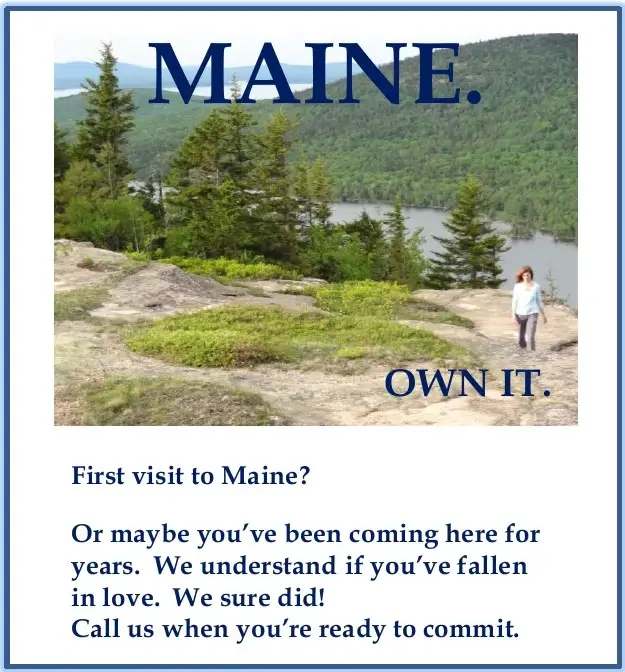

Experience personalized service in the Maine tradition.

Contact us today at (207) 288-2881.

"Quality is never an accident; it is always the result of high intention, sincere effort, intelligent direction and skillful execution; it represents the wise choice of many alternatives." ~ W. Foster

We care what our customers think of us and so should you. We are partners in your business and your success is ours.

Rating

Rating

3 months ago

8 months ago

1 year ago

1 year ago

2 years ago

2 years ago

3 years ago

3 years ago

4 years ago

4 years ago

4 years ago

4 years ago

4 years ago

Refinancing a home mortgage can be a big decision for many homeowners. Your situation and needs change over time so why shouldn't your mortgage?

Conventional loans have better rates, terms and/or lower fees than other types of loans, ideal for borrowers with excellent credit and at least a 5% down payment.

Insured by the Federal Housing Administration, FHA loans are best for first-time home buyers and those who less than perfect credit looking to qualify for a mortgage.